Hydrogen horizon: unlocking opportunities in the clean H2 economy (Part 2)

Along the Life Cycle: Unveiling Opportunities in Storage, Transportation and Usage

As discovered in the previous issue, the clean H2 value chain works along the three key stages of (1) Production, (2) Storage and Transportation, and (3) Utilization. After we have covered H2 production and deep-dived into electrolysis as one method that presents significant innovation potential, we are now moving to stages (2) and (3).

🛣️ Storage and Transportation

In the realm of the emerging clean H2 economy, efficient storage and transportation face strong challenges including the need to reduce cost, increase energy efficiency, maintain hydrogen purity, and minimize hydrogen leakage. Let's delve into the different methods, associate challenges and potential solutions:

Storage

Current methods for H2 storage include Compressed Gas Storage, Liquid Hydrogen Storage, Liquid Organic Hydrogen Carriers (LOHC) technology and Solid-State Storage. While they have different approaches, they all aim to address the common challenges in hydrogen storage including cost and energy efficiency, density and volume, and safety and leakage.

💸Cost and Energy Efficiency

High costs associated with storage materials, infrastructure, and energy-intensive processes hinder widespread adoption of clean H2. Hence, improving the cost-effectiveness and energy efficiency of storage technologies is a key challenge. To address this, storage in salt caverns is considered a leading option for large scale storage, but is limited to areas with compatible geology. Smaller scale storage of hydrogen as compressed gas in metal tubes is not geographically limited but more expensive. Further, liquid hydrogen is used as an intermediate form of storage, but incurs an energy cost for liquefaction and suffers from boil-off losses over time. Chemical forms of storage require more detailed analysis on the roundtrip efficiency and economics. A new form of storage under active development that offers both, the economic benefits of large scale as well as a level of geographic optionality, are lined rock cavern (LRC) storage system. The LRC method relies on excavation of a large cavern several hundred meters under solid rock, which is then clad in a thin layer of steel (ensuring leak-tightness) and back-filled with concrete (to handle pressure). These developments are based on a commercial LRC storage system for natural gas that has been in successful in operation in Sweden for the past 20 years.

🧪 Density and Volume

Hydrogen has low density which presents challenges in storing and transporting it efficiently. Increasing the energy density of hydrogen storage methods allows for more hydrogen to be stored in a given volume, reducing storage space requirements and enabling longer-range transportation. Solid-state storage where hydrogen is stored within specific materials, such as metal hydrides or proprietary alloys, offers higher density compared to compressed gas storage. However, challenges remain in finding suitable materials with high hydrogen storage capacity, optimizing the kinetics of hydrogen absorption and release, and achieving economic feasibility. Startups like Hydrexia, Rouge H2, and StoreH are actively involved in the development of solid-state storage solutions, addressing these challenges and advancing the field.

🚨 Safety and Leakage

Hydrogen is highly flammable and requires stringent safety measures to prevent accidents and ensure safe handling during storage and transportation. Minimizing hydrogen leakage is vital to prevent losses, maintain system efficiency, and ensure the safety of personnel and the environment. Companies like SPEC Sensors aim to create robust and reliable meshed sensor networks for hydrogen leak detection and line-monitoring systems.

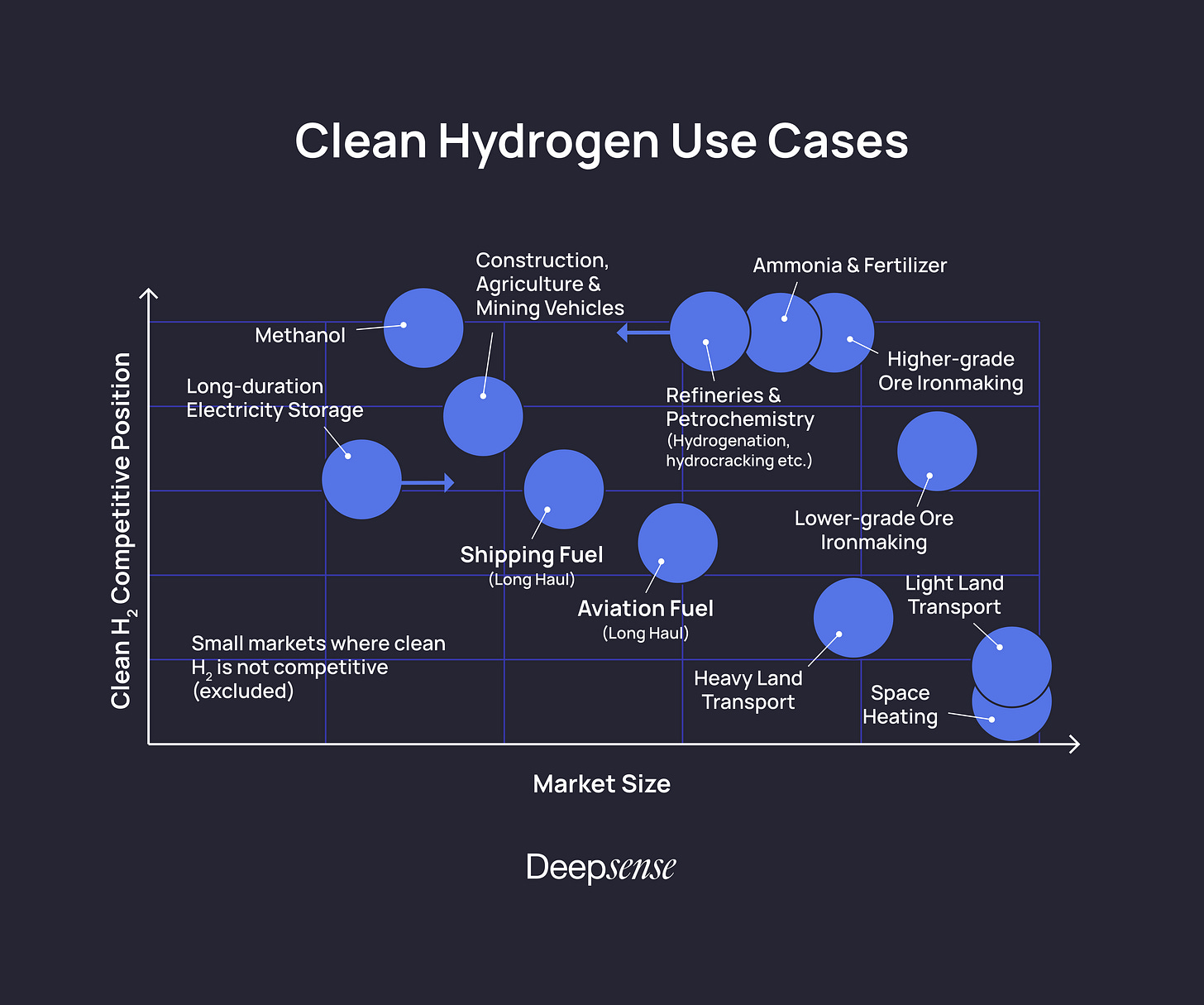

This chart is indicative only and, on the x-axis, not to scale. Blue arrows indicate likely relative development of market size going forward. For shipping fuel and aviation fuel, “clean hydrogen” includes synthetic fuels made from hydrogen and other constituents, either ammonia or “drop in” replacement hydrocarbon fuels made from clean hydrogen and carbon (possibly sourced from captured CO2). For a more thorough walk-through of likely hydrogen use-cases, we recommend Michael Leibreichs “hydrogen ladder” post, most of which we agree with in broad terms, and which also inspired this graph.

Transportation

Hydrogen transportation involves various methods, including pipeline transport, tube trailers, liquid hydrogen transport and conversion into ammonia to use the existing shipping infrastructure. Apart from leakage and safety systems as covered for storage, transporting hydrogen poses various additional challenges related to robust infrastructure.

🚧 Robust & Advanced Infrastructure

There are about 1,600 miles of H2 pipelines in the US, but an increase of at least an order of magnitude may be needed to support a large-scale hydrogen economy. For comparison, there are about 3 million miles of natural gas pipelines in the US and there is interest in blending H2 into this existing infrastructure or repurposing it entirely for H2 transport. Similar plans exist in Europe for a large “hydrogen backbone” consisting of both repurposed natural gas pipelines and new dedicated hydrogen pipelines. A key question for conversion is metal embrittlement of the pipelines which introduces reliability and safety issues. Therefore, careful selection of materials is necessary to ensure pipeline safety and durability. Evaporation losses during transport can occur despite insulation, leading to hydrogen losses and increased costs. Startups like Smartpipe Technologies and Tree Energy Solutions (TES) focus on developing robust H2 transportation infrastructure using existing pipeline systems.

End Use Applications

🪃 Proven Pathways

Hydrogen already plays a significant role in various industries today. It is commonly used in sectors such as ammonia production for fertilizers, methanol production for the chemicals industry, and oil refining. However, the hydrogen utilized in these processes is almost exclusively derived from fossil fuels. By focusing on supplying clean hydrogen to these sectors, existing infrastructure, expertise, and demand in these sectors can be leveraged. Hence, it serves as a logical starting point to drive the widespread adoption of clean H2. Unavoidable, proven and substantial future use cases for clean hydrogen include ammonia and ammonia-based fertilizers and methanol, as well as a - likely diminished but continuing - role in refining, such as various type of hydrogenation/hydrocracking and desulphurization.

🚀 Going Beyond?

The recent policy push has created a landscape where there is an appetite to demonstrate the potential of clean H2 technologies as options for decarbonization and has stimulated innovation around the use of clean H2 across a broad range of applications. In transportation and energy storage applications, hydrogen is typically in direct competition with batteries. A general principle that holds across industries and applications is that the smaller the battery needed, the more difficult it is for hydrogen to compete.

In sectors where hydrogen has direct competition from smaller batteries, such as in personal vehicles, it seems clear that hydrogen has already lost the race. Any previously touted benefit of hydrogen fuel cell cars as compared to electric vehicles has evaporated as battery performance and energy density increased rapidly and dramatically. A similar story appears to be unfolding in all categories of heavier conventional road transport where viable battery-electric options are being brought to market at breakneck speed, closing the window on any major role for hydrogen. More specialized applications where the required size and weight of batteries as well as difficulties in swapping and/or charging mean batteries are a difficult option, hydrogen stands a much better chance. This includes vehicles in sectors such as construction, mining and agriculture where, for example, British industry giant JCB is developing new hydrogen product lines. The obvious implications – potential success for hydrogen in specialized vehicle markets notwithstanding – is that the future of hydrogen use in land vehicles will be a tiny fraction of what was envisioned just a few years ago when this sector was often the dominant envisioned future hydrogen use case.

However, other major use cases are emerging. Adhering to the battery-size-complication principle above, there is significantly larger potential for hydrogen or clean-hydrogen-derived fuels, to compete against batteries in air transport and ocean shipping. The longer the haul and the larger the payload, the easier it is for hydrogen or hydrogen-derived fuels to compete. Startups like ZeroAvia, Beyond Aero, Universal Hydrogen are developing hydrogen-electric powertrains for aircraft while others are looking at using hydrogen directly as engine fuel, including Airbus. Another hydrogen-based pathway to decarbonize air travel is to manufacture synthetic drop in replacement hydrocarbon “E-fuel”, like jet-A fuel produced from syngas (hydrogen & carbon monoxide), as pursued by startups like Twelve. The advantage of this approach is that the drop-in-replacement fuel requires no modification to current aircraft engine technology. The challenge is the substantial cost and complexity of the fuel production system with perhaps the main issue not being the hydrogen but the sourcing of carbon (typically envisioned as captured CO2 which is then reduced to CO). Hydrogen or hydrogen-derived fuels such as ammonia are also a key prospect for decarbonizing shipping (Amogy, MAN, WindGD, CMB).

For applications in the power sector, it is important to remember that clean hydrogen is not an energy source itself but a method to store energy. Producing clean hydrogen from electricity, compressing, storing, and finally turning it back in to electricity in fuels cells or using hydrogen gas turbines has a cycle efficiency on the order of 30-40%, meaning you typically get less than 3 or 4 units of electricity back for every 10 you put in. Batteries, by comparison, are at 90% or more round-trip efficiency. The major competitive advantage of hydrogen in the power sector is the relative cheapness of storing it at large scale compared to batteries. Following, the main sensible application would be long-duration-storage applications in regions that lack the geographic conditions for more cost-effective alternatives like pumped hydro storage.

In heating applications, particularly for home heating, hydrogen boilers are unlikely to gain market share. Alternatives such as electric heat pumps are way more energy efficient and already a proven and commercially mature technology. For the delivery of higher temperature heat, hydrogen combustion might make more sense but, again, electric heating options are available and will typically do the same job more effectively and cheaply.

Finally, a potentially very large emerging use case for hydrogen is in the process of ironmaking – the conversion (reduction) of iron ore (hematite or magnetite) into metallic iron. Removing oxygen from iron ore is one of the world’s major industrial processes and is today primarily carried out in blast furnaces using coking coal. Carbon atoms remove oxygen from iron ore to form CO2, leaving behind metallic iron that is then further processed into steel: the main building block of the modern world. These processes are responsible for 7-8% of all global CO2 emissions today. Clean hydrogen can - in principle - replace the role of coal, reducing iron ore to metallic iron by snatching up oxygen and forming steam. Steel is then manufactured from this material, called “sponge iron”, in Electric Arc Furnaces. In a system with clean electricity supply, nearly all emissions can be driven out of the process. At least a dozen major industrial plans for H2-DRI (hydrogen direct reduced iron) have been launched in Europe alone, with more announced almost daily worldwide. Companies like Tenova/HYL, Midrex, POSCO and Metso Outotec are developing the new furnace technology to make this possible. Apart from the furnaces themselves, an entire ecosystem of innovative technologies have the potential to emerge around these new types of plants. Technology alternatives to H2-DRI for zero-emissions ironmaking are emerging, such as the molten oxide electrolysis method developed by Boston Metal, a novel electrochemical method developed by ElectraSteel, and the hydrogen plasma technology in development by Ferrum Technologies. The H2-DRI pathway offers more technical maturity, higher flexibility (using hydrogen storage) and a lower total electricity consumption than these alternatives. The main drawback of H2-DRI, and the main advantage of competing methods, is that H2-DRI technology is primarily suited for very high-purity iron ores with only minor impurities which constitute only a small fraction of total iron ore mining.

🔍 Challenges and Opportunities in the Clean Hydrogen Journey: A Summary

In our exploration of the clean hydrogen sector, we have observed the rise of an unprecedented wave driven by decarbonization goals and discovered challenges and opportunities along the clean H2 value chain. Challenges include cost optimization, supply chain risks, and infrastructure development. However, companies across the value chain are innovating and propelling the sector forward and increasingly look into integrating storage, transport, and generation into a single package to address both cost optimization and infrastructure development. By addressing challenges and capitalizing on economically feasible opportunities, we can unlock the full potential of clean hydrogen and pave the way for a sustainable energy future.

⛹️ Players in Hydrogen Distribution

Tree Energy Solutions (TES) 🇧🇪

Develops hydrogen supply and import hubs in Germany, Belgium, the Netherlands, France, Canada and the US to integrate and optimize global supply chains.

Founded: 2019

Disclosed amount raised to date: $214MM

Last disclosed round: Early Stage VC, October 2022

Disclosed investors: AtlasInvest, E.ON, Fortescue Future Industries, HSBC Holdings, UniCredit, and Zodiac Maritime

EnerVenue 🇺🇸

Provides metal-hydrogen batteries for large-scale renewable and storage applications.

Founded: 2020

Disclosed amount raised to date: $132MM

Last disclosed round: Series A, December 2021

Disclosed investors: Aramco Ventures, IDG Capital, Plug and Play, Schlumberger, and several Angel Investors

Hydrogeneous Technologies 🇩🇪

Develops innovative solutions for safe and efficient hydrogen storage in liquid organic hydrogen carriers.

Founded: 2013

Disclosed amount raised to date: $77MM

Last disclosed round: Series B, September 2021

Disclosed investors: AP Ventures, Chevron Technology Ventures, Covestro, Hyundai Motor, Mitsubishi, JERA Americas, Pavilion Capital, Startup Autobahn, Temasek, Vopak Ventures, and Winkelmann Group

Steelhead Composites 🇺🇸

Provides hydrogen storage solutions used to allow widespread zero-emission fuel cell electrification.

Founded: 2012

Disclosed amount raised to date: $33.5MM

Last disclosed round: Growth, July 2023

Disclosed investors: 3D Ventures, Altitude Ventures, GVC Capital, John Lilly Strategic Insights, Keiretsu Forum, Lateral Capital Management, Lorentzen Investments, Milkbox Partners, Sandusky Ventures, Sutton Capital, Tamarack Capital Partners, Tamarack Global, WorldQuant Ventures, and several Angel Investors

HySiLabs 🇫🇷

Develops a solution to facilitate hydrogen transportation and storage, by charging it in a safe liquid carrier.

Founded: 2015

Disclosed amount raised to date: $19MM

Last disclosed round: Series B, July 2023

Disclosed investors: Bpifrance, CAAP Creation, EDP Ventures, EIT InnoEnergy, Equinor Ventures, Exolum Group, Kreaxi, PLD Automobile, and Vopak Ventures

Smartpipe Technologies 🇺🇸

Develops a robust, self-monitored, repurposed pipeline system for hydrogen with minimal environmental disruption.

Founded: 2000

Disclosed amount raised to date: $17MM

Last disclosed round: Later Stage VC, May 2022

Disclosed investors: Enbridge, Greentown Labs, Houston Technology Center, and Kenda Capital

DENS 🇳🇱

Develops liquid state storage solutions for hydrogen.

Founded: 2015

Disclosed amount raised to date: $14MM

Last disclosed round: Series A, October 2021

Disclosed investors: Brabant Startup Fund, Goeie Gutten Impact Fonds, and Koolen Industries

Sylfen 🇫🇷

Develops energy storage and production systems using a reversible electrolyzer and fuel cell for the storage of solar energy in hydrogen form as well as the production of energy from methane.

Founded: 2015

Disclosed amount raised to date: $11MM

Last disclosed round: Later Stage VC, May 2022

Disclosed investors: Amundi, Bpifrance, CEA Investissement, EIT InnoEnergy, Elais Orium, IDEC (Osaka), and Supernova Invest

Electriq 🇮🇱

Develops hydrogen carrier systems intended for off-grid applications and long-term storage.

Founded: 2013

Disclosed amount raised to date: $7MM

Last disclosed round: Series B, February 2022

Disclosed investors: BIRD Foundation, Horizon GreenTech Ventures, and Southern Isreal Bridging Fund

H2GO Power 🇬🇧

Develops hydrogen energy storage technology.

Founded: 2014

Disclosed amount raised to date: $3MM

Last disclosed round: Series A, October 2021

Disclosed investors: Accelerate Cambridge, Somerset Capital, and several Angel Investors

Immaterial 🇬🇧

Manufactures super-adsorbent nanomaterials which can dramatically reduce the cost of separating, storing, and transporting gas.

Founded: 2015

Disclosed amount raised to date: $1.4MM

Last disclosed round: Seed, Undisclosed

Disclosed investors: Accelerate Cambridge, Cambridge Enterprise, EIT Climate-KIC, Flobas Ventures, Net Zero Technology Centre, and Plug and Play

Hydro X 🇮🇱

Develops a hydrogen storage technology which enables to store and transport hydrogen in a green, cost and energy efficient way.

Founded: 2015

Disclosed amount raised to date: $1MM

Last disclosed round: Series A, March 2021

Disclosed investors: MassChallenge, Other Sources Energy Group, and several Angel Investors

GRZ Technologies 🇨🇭

Manufactures hydrogen-based power-to-power systems and thermochemical hydrogen compressors.

Founded: 2016

Disclosed amount raised to date: $1MM

Last disclosed round: Pre-Seed, February 2020

Disclosed investors: EIT Climate-KIC, Hyundai Motor, and Venture Kick

Rouge H2 🇦🇹

Focuses on the development of hydrogen production, solid state storage and OSOD™ (On-Site On-Demand) systems.

Founded: 2015

Disclosed amount raised to date: N/A

Last disclosed round: N/A

Disclosed investors: N/A

StoreH 🇮🇹

Develops solid state storage for hydrogen.

Founded: 2019

Disclosed amount raised to date: N/A

Last disclosed round: N/A

Disclosed investors: N/A

⛹️ Players in Hydrogen Utilization

H2 Green Steel 🇸🇪

Builds the world's first renewable hydrogen-based integrated steel mill.

Founded: 2020

Disclosed amount raised to date: $2B

Last disclosed round: Series B, October 2022

Disclosed investors: Altor Equity Partners, AMF, A.P. Moller Holding, EIT InnoEnergy, Exor Group, FAM, Ferdinand Bilstein, GIC, Hitachi Energy, IMAS Foundation, Just Climate, Kingspan Group, Kinnevik, Kobelco Construction Machinery, Kobe Steel, Marcegaglia, Mercedes Benz, Scania, Schaeffler, SMS Group, Stena, Swedbank Robur, Vargas Holding, and several Angel Investors (including Daniel Ek)

ZeroAvia 🇺🇸

Develops hydrogen-electric, zero-emission powertrains for air.

Founded: 2017

Disclosed amount raised to date: $268MM

Last disclosed round: Series B, July 2022

Disclosed investors: AENU, Alaska Air, Alaska Star Ventures, Aloniq, Alumni Ventures, American Airlines, AP Ventures, Breakthrough Energy, British Airways, Elemental Execelerator, Horizons Ventures, IAG Capital Partners, Impala Ventures, NEOM, Phystech Ventures, Plug and Play, SGH Capital, Shell Ventures, Summa Equity, Sustainable Impact Capital, SystemiQ, Terra.VC, The Climate Pledge, The March Group, United Airlines Ventures, Waarde Capital, and several Angel Investors

FirstElement Fuel 🇺🇸

Provides customers with retail hydrogen fueling for the next generation of vehicles powered by fuel cells.

Founded: 2013

Disclosed amount raised to date: $227MM

Last disclosed round: Series D, November 2021

Disclosed investors: Air Liquide, Air Water, Honda Motor Company, Japan Infrastructure Initiative Company, Mitsui & Company, Nikkiso, and Toyota Motor

Riversimple 🇬🇧

Manufactures hydrogen-powered fuel cell electric vehicles (FCEVs).

Founded: 2001

Disclosed amount raised to date: $223MM

Last disclosed round: Equity Crowdfunding, March 2023

Disclosed investors: Angels Invest Wales, bScope Partners, Development Bank of Wales, Pario Ventures, Piech-Nordhoff and several Angel Investors

Hydrogen Vehicle Systems (HVS) 🇬🇧

Builds hydrogen fuelled trucks.

Founded: 2017

Disclosed amount raised to date: $164MM

Last disclosed round: Corporate, September 2022

Disclosed investors: EG Group and several Angel Investors

H2 Mobility 🇩🇪

Operates a hydrogen refueling station network for fuel cell vehicles.

Founded: 2015

Disclosed amount raised to date: $131MM

Last disclosed round: Growth, April 2022

Disclosed investors: Air Liquide, Hy24, Hyundai Motor, Linde, Mercedes-Benz Group, OMV, Shell, Total Energies, and VINCI Concessions

Syzygy Plasmonics 🇺🇸

Develops a photocatalytic reactor designed for fuel cell vehicles and small-scale industrial applications.

Founded: 2017

Disclosed amount raised to date: $118MM

Last disclosed round: Series C, November 2022

Disclosed investors: Aramco Ventures, Band Capital Partners, BP Ventures, Capital Factory, Carbon Direct Capital Management, Chevron Technology Ventures, Climate Impact Capital, Creative Destruction Lab, Equinor Ventures, Evok Innovations, GOOSE Capital, Horizons Ventures, Lotte Chemical, New Climate Ventures, Pan American Energy, Sumitomo Corporation, The Engine and Toyota Ventures

Universal Hydrogen 🇺🇸

Manufactures capsule modules intended to safely store hydrogen during transit and also act as modular fuel tanks that load directly onto aircraft.

Founded: 2020

Disclosed amount raised to date: $85MM

Last disclosed round: Series B, October 2021

Disclosed investors: 75 & Sunny, Airbus Ventures, American Airlines, Build Collective, Coatue Management, Fortescue Metals Group, Fourth Realm, GE Aerospace, Global Founders Capital, Global Green Capital, Hawktail, JetBlue Ventures, Mitsubishi HC Capital, Playground Global, Plug Power, Side Door Ventures, Sojitz, Startos, Tencent Holdings, Templewater, Time Ventures, Toyota Ventures, Trucks Venture Capital, and Waltzing Matilda Aviation

Quantron 🇩🇪

Provides systems of clean battery and hydrogen-powered e-mobility for commercial vehicles such as trucks, buses, and vans.

Founded: 2019

Disclosed amount raised to date: $60MM

Last disclosed round: Series A, September 2022

Disclosed investors: Ballard Power Systems, EvDynamics, FUND4SE, and Neuman & Eser

Bramble Energy 🇬🇧

Designs and manufactures a high-performance, low-cost, and fuel cell stack.

Founded: 2016

Disclosed amount raised to date: $55MM

Last disclosed round: Series B, February 2022

Disclosed investors: AlbionVC, BGF, HydrogenOne Capital Growth, IP Group, Parkwalk Advisors, and UCL Technology Fund

H3 Dynamics 🇸🇬

Develops and commercializes Hydrogen Propulsion Solutions, from Unmanned Systems to Large Passenger Aircraft.

Founded: 2015

Disclosed amount raised to date: $42MM

Last disclosed round: Series B, April 2021

Disclosed investors: ACA Investments, AOI Group, Ascent Funds, Audacy Ventures, EDBI, Enterprise Singapore, Grosvenor, SPARX Group Company, and SPRING Seeds Capital

KEYOU 🇩🇪

Develops a hydrogen combustion technology designed to clean vehicle emissions and exhausts.

Founded: 2015

Disclosed amount raised to date: $28.5MM

Last disclosed round: Series B, December 2021

Disclosed investors: BA, Besto GmbH, European Innovation Council Fund, NAGEL Maschinen- und Werkzeugfabrik, and PortXL - Port & Maritime Accelerator

ATAWAY 🇫🇷

Designs, manufactures and distributes green hydrogen refueling stations.

Founded: 2012

Disclosed amount raised to date: $28MM

Last disclosed round: Growth, January 2023

Disclosed investors: BNP Paribas, Bpifrance, Crédit Agricole, Groupe IDEC, and Starquest Capital

Hype Taxi 🇫🇷

Develops a hydrogen mobility platform starting with FCEVs taxis.

Founded: 2009

Disclosed amount raised to date: $21MM

Last disclosed round: Later Stage VC, January 2023

Disclosed investors: Air Liquide Venture Capital, Eiffel Investment Group, Holding Hr, Kouros Investment, McPhy Energy, Mirova, RAISE Group, Rgreen Invest, and VINCI Concessions

Hydra Energy 🇨🇦

Develops a hydrogen-as-a-service technology and systems designed to provide hydrogen supply and fuelling for commercial vehicle fleets.

Founded: 2021

Disclosed amount raised to date: $16MM

Last disclosed round: Series A, May 2021

Disclosed investors: Foresight Canada, Just Business, and Sustainable Development Technology Canada

EH Group 🇨🇭

Develops an innovative hydrogen fuel cell technology.

Founded: 2017

Disclosed amount raised to date: $9MM

Last disclosed round: Series A, January 2022

Disclosed investors: AP Ventures, CalSEED, Fondation The Ark, and W. A. de Vigier Foundation

Beyond Aero 🇫🇷

Develops a zero-emission private aircraft powered by hydrogen-electric propulsion.

Founded: 2020

Disclosed amount raised to date: $4MM

Last disclosed round: Series A, April 2022

Disclosed investors: 7percent Ventures, AngelSquare, Aonia Ventures, Arion Venture Capital, Innostart Capital, Kima Ventures, Lombardstreet Ventures, Unruly Capital, Y Combinator, and several Angel Investors

Solenco Powerbox NV 🇧🇪

Develops a combination of an electrolyser and a fuel cell in one unit.

Founded: 2015

Disclosed amount raised to date: $2MM

Last disclosed round: Grant, March 2020

Disclosed investors: European Innovation Council Fund

ULEMCo 🇬🇧

Develops technologies that enable commercial vehicles to run off hydrogen.

Founded: 2014

Disclosed amount raised to date: $1.5MM

Last disclosed round: Series A, April 2021

Disclosed investors: 350 Investment Partners, Dunelm Energy, Equity Gap, Scottish Enterprise, and The North West Fund

Inergio🇨🇭

Develops miniaturized fuel cell power systems.

Founded: 2014

Disclosed amount raised to date: $1.4MM

Last disclosed round: Seed, November 2021

Disclosed investors: DART Labs, Privilège Ventures, StartAngels Network, and Venture Kick

Celcibus 🇸🇪

Develops affordable and sustainable fuel cell catalysts through a patented noble metal-free catalyst technology.

Founded: 2019

Disclosed amount raised to date: $160k

Last disclosed round: Seed, June 2023

Disclosed investors: EIT InnoEnergy, Klimatet Invest, and Sustainable Energy Angels

Ferrum Technologies 🇦🇹

Develops a hydrogen plasma-based steel production approach.

Founded: 2022

Disclosed amount raised to date: N/A

Last disclosed round: N/A

Disclosed investors: Unruly Capital

PowerUP Energy Technologies 🇪🇪

Develops hydrogen fuel cell-based electrical generators for yachts, recreational vehicles, and electric cars.

Founded: 2016

Disclosed amount raised to date: N/A

Last disclosed round: N/A

Disclosed investors: Beamline, Berkeley SkyDeck, Cleantech Estonia, Nordic Asian Venture Alliance, and Vee Perearstikeskus

Want more insights?

At Deepsense, we help investors make smarter science and technology investments through access to our expert network. We offer in-depth qualitative and quantitative analyses on a variety of domains covering 80+ deep tech areas. We recently added experts in Biomass, Medical Devices, Microbial Electrochemical Systems (MES), Pharmaceuticals, and Water Treatment.

If you are an investor interested in working with us, go here.

If you are a science-tech expert looking to join our network, go here.

That's a wrap for this issue of Deepsense Insights. Keep an eye out for our next issue, where we'll uncover even more groundbreaking technologies that are reshaping our future. 🌌